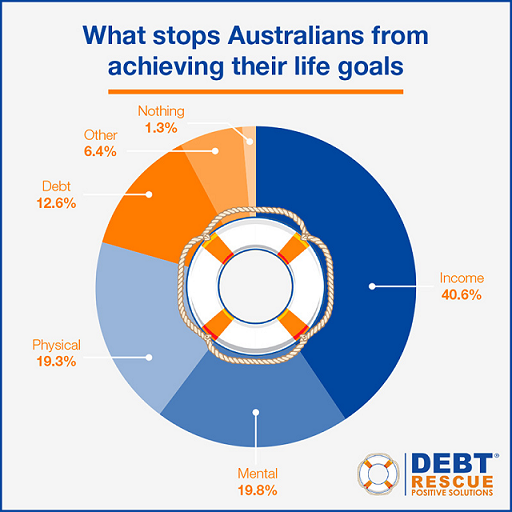

Financial factors are stopping more than half of Australians from achieving their life goals, according to research by Revive Financial. As many as 53.2% of those surveyed responded with income and debt as being the main factor inhibiting their aspirations in life. Physical and mental health were the main factors for nearly two in five Australians (39.1%).

Income Prevents Australians Achieving Life Goals the Most

Not earning enough money was the top reason for Australians not being able to achieve their life goals. Unless you’re already earning an obscenely large wage, who wouldn’t want to earn more money? But some may say the grass is always greener when it comes to earning a living. Financial planner Ross Marais said he has some clients who earn an annual salary of more than $200,000 who are still in significant debt and struggle to achieve their life goals.

“I don’t believe that higher income solves this problem, it can sometimes make this worse,” he said.

“When you earn more you have a higher level of expenses (potentially) which means if you don’t have that income anymore then you have a higher level of income to support which where the debt can come in.”

As a country with the highest minimum wage in the world and an average annual income of nearly $62,000, many Australians would be considered to be comfortable enough. But for those who require help with Revive Financial, the average annual income was $48,000 and when it comes to household debt, Australia has more of it than most other countries.

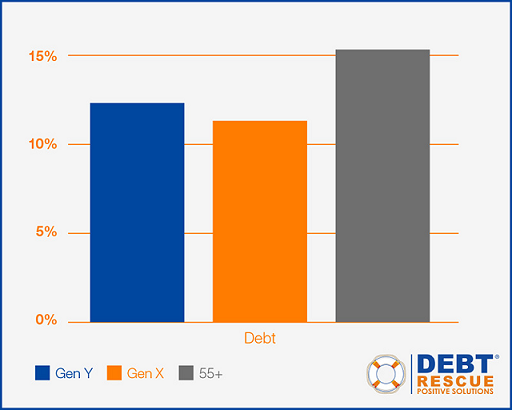

Debt is More of a Factor for Australians Older than 55

Of course, Australians of all ages experience debt in some shape or form. The average age for our own clients wanting to reduce their debt is somewhere between 30 and 50 years-old. In this recent survey, it was Australians aged 55 years-old and over who said debt stopped them from achieving their life goals more than any other age group.

Despite our own statistics and data from the Australian Bureau of Statistics proving debt is likely to be higher for those younger than 55, a higher percentage of Australians older than this age still saw debt as an inhibiting factor in life. This could be due to younger generations perceiving other factors, like mental health, negatively affecting them more than debt to achieve goals.

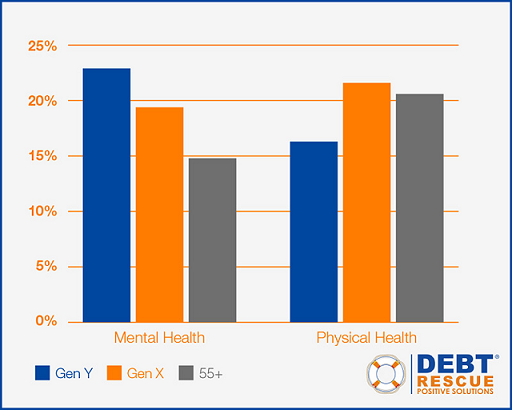

Younger and Older Australians Feel Different about their Health

The percentage of respondents who said mental or physical health stopped them from achieving their life goals was very similar – about 19-20%. Understandably, Australians from the youngest and oldest age-groups felt differently about which aspect of their health affected them the most when it came to achieving life goals.

Nearly one in four Generation Y respondents (22.9%) said mental health was a major factor while about one in seven respondents 55 years-old and over gave this response. For those who are yet to establish their career and set themselves up for retirement, the pressure to succeed in securing a decent job can be great. Australian women around the age of motherhood can also suffer from factors affecting their mental health when returning to work, according to career coach Leah Lambart.

“Lack of confidence is another huge hurdle for people achieving their goals, particularly for women who have been out of the workforce on family leave,” she said.

“I have also worked with many clients (some extremely intelligent and engaging) who have not reached their career goals due to suffering from anxiety and depression. This has forced them to push their careers to one side and focus on achieving better health.”

CEO of SunnyKids, Chris Turner, said that financial stress is one of the major factors that the service often sees when families and children are referred for help.

“We take a holistic approach to helping families to cope and address issues of disadvantage and financial stress or hardship can make a massive impact on almost every element of their lives. Very often we discover that a local child struggling at school doesn’t have food on the table at home or adequate shelter. We rely on a number of support agencies and services and we appreciate the incredible work that companies like Revive Financial does by helping clients through the Cooroy Family Support Centre,” Chris said.

“Sometimes financial counselling and debt relief is enough to transform a family’s whole situation and outlook and we know that breaking the poverty cycle is critical for raising healthy, happy kids across generations,” he said.

SunnyKids has seen firsthand how Revive Financial’s debt relief solutions can make a difference to a struggling family. Revive Financial has offered individualised support for a range of our clients, including basic budgeting assistance through to assisting with reducing debt repayments. One client had substantial debt and was parenting 3 young children but struggling to make ends meet week to week. Revive Financial helped to decrease the payments of money owing, provided very simple budgeting strategies and assisted the client to manage. They soon moved to a better home and are now enjoying life just a little bit more, with less financial stress.

Methodology

Survey results included responses from 591 Australians aged 18 and over.

The organisers of this study incentivised 2 groups of participants to participate in this study:

- Internet users across a range of programs who are rewarded for their opinion in exchange for access to free content

- Smartphone users who opt in to participate in opinion polls in exchange for rewards determined by the research company

Internet users’ locations are determined using their IP and their demographic data is based on the target user profile of the website. Smartphone users who opt in provide this information upon signing up to the rewards program. The organisers of this study ensure a balanced opinion poll by ensuring the sample of the study reflects the demographics of the target audience. For example, internet users over the age of 18. Such demographics include age, gender and geographic location. In Australia, we rely on data from Government sources such as the Australian Bureau of Statistics (ABS) and other sources of data provided by web partners such as Google.

The organisers of this study maintain the integrity of the research data by using the following 2 steps:

- Stratified sampling by filtering demographic data to align with the intended audience, and

- Post-stratification weighting to ensure consistency between intended and actual audience population data.