When debts, such as unsecured personal loans and credit cards with high-interest rates, become a problem and you’re struggling to meet your obligations, a debt consolidation loan can help you regain control of your finances.

But here’s the catch-22: as a person’s debts get worse, so does their credit history and credit score, and then they can’t secure a consolidation loan.

This common situation leaves many Australians feeling there’s no way out of their debt situation. The good news is that consolidating debts into one easy-to-manage loan is possible, even with bad credit.

Debt Consolidation Loans: Bad Credit?

While the big banks and financial institutions have hardship assistance in place, they’ll rarely lend money to someone with bad credit to help them improve their situation.

However, there are lenders out there who specialise in lending to Aussies doing it tough, whether they’re in debt, have a bad credit rating or are recovering from bankruptcy.

These non-conforming lenders don’t use traditional lending criteria, making borrowing money possible for people with a bad credit rating. It’s through these lending specialists that you can access a debt consolidation loan even with bad credit.

How Debt Consolidation Loans Ease the Strain

Once a lender approves you for a debt consolidation loan, you can pay out your existing multiple debts, including unsecured loans. This will leave you with:

- one loan repayment

- one interest rate to keep track of

- one set of fees, and

- one regular repayment to make

The reduced interest should save money over the life of the loan, and the single repayments will be much easier to keep on top of.

Over time, any defaults on your credit report will be removed. If you keep up with your new consolidated loan repayments, you should have a clean slate by the time you’ve repaid your debt.

See How Consolidation Could Work for You

If you’d like to see the figures around how a bad credit debt consolidation loan could help you and your specific situation, check out our Debt Consolidation Loan Calculator.

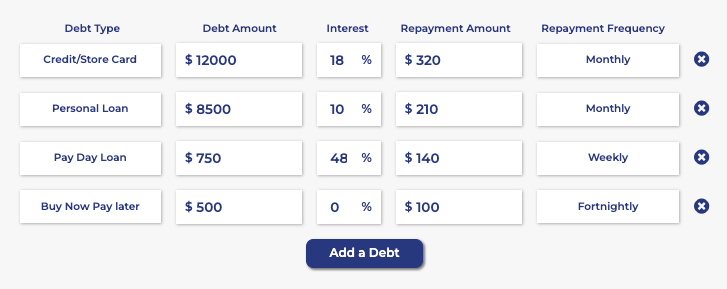

First, select the different types of bad debt you owe from the following list:

- Credit/store card

- Personal Loan

- Pay Day Loan

- Buy Now Pay Later

- Tax Debt

- Disconnected Utility

- Other

Once you’ve done that, type in the current amount you owe for each, the interest rates, your repayment amounts and your repayment frequency (e.g. weekly or monthly payments).

Here's an example:

- Credit card

- $8,000

- 20% interest rate

- $400 repayments

- Monthly

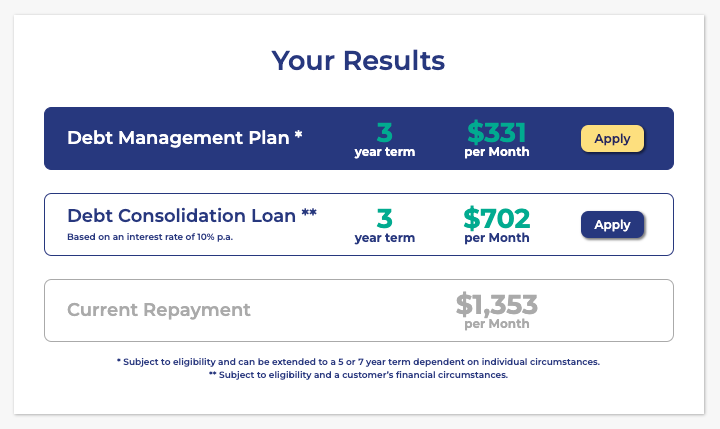

When you press calculate, the debt consolidation calculator shows you suitable consolidation loan terms and the difference in what you would pay back each month.

Bad Credit and Can’t Get a Debt Consolidation Loan?

If you can’t get a debt consolidation loan due to bad credit, don’t worry; you have other options.

An informal debt agreement or a government-registered Debt Agreement are other ways to get out of debt while avoiding bankruptcy.

Here’s a quick run-down of each:

- Informal debt agreement - An informal debt agreement is an arrangement between you (the debtor) and your creditors to manage and repay your outstanding debts.

- Debt agreement - A Part IX (9) Debt Agreement is a legally binding agreement between you and your creditors to repay a portion—an agreed reduced amount—of your outstanding debts over a specified period.

Both informal debt agreements and Part 9 Debt Agreements have advantages and considerations. Your choice should depend on your financial situation, goals and preferences. We recommend seeking expert assistance when making this decision.

Take Back Control of Your Bad Credit

Problem debt and bad credit can take over your life and happiness if you let it. But even when your finances seem unmanageable, help and options are available.

Start by seeking advice and figuring out if consolidating debt with a debt consolidation loan will work for your bad credit. In many cases, it can. If it can’t, a debt agreement might be your best option for taking back control and enjoying a debt-free future.

If you’d like to talk to an expert about your situation and find out if you can access debt consolidation loans with bad credit, contact our debt solution specialists today on 1800 534 534 for professional, non-judgmental support and advice and affiliate lender options.

%20%20(1).gif)