With the increasing use of buy-now-pay-later (BNPL) methods in Australia, a number of banks have launched a new interest-free credit card to compete against BNPL companies such as AfterPay and ZipPay.

On 10 September 2020, NAB launched the NAB StraightUp Card, Australia’s first no-interest credit card with the Commonwealth Bank following suit just days later, announcing the Commbank Neo.

Credit card debt has dropped immensely since the Coronavirus hit, with billions of debt being wiped due to strict lockdown measures causing businesses to close and Australians to focus more on essential living expenses rather than using credit.

The July 2020 credit card debt statistics released from the Reserve Bank of Australia (RBA) show that the national credit card debt is now at just under $22.5 billion compared to the previous year where it was at $30.4 billion.

The decrease of credit card use caused a surge of Australians to start using BNPL methods. A 2020 Mozo BNPL report found 30% of Australian adults now have a BNPL account, equating to 5.8 million users.

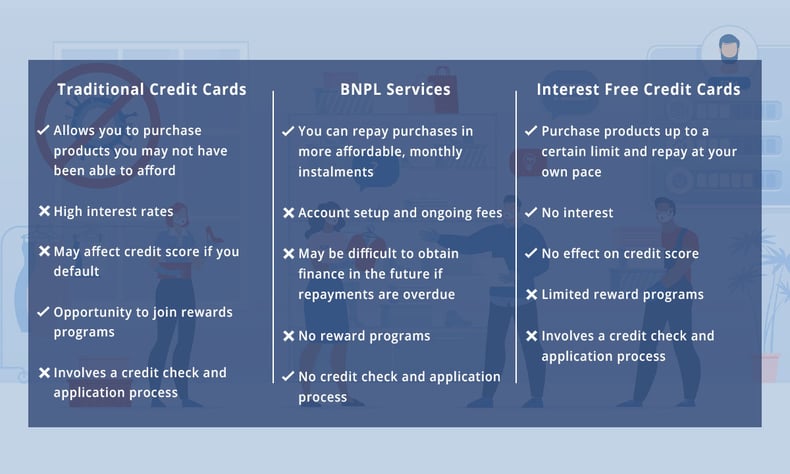

It’s expected that the new interest-free credit card will lure financially-conscious shoppers away from BNPL methods and traditional credit cards. However, it’s important to understand the advantages and disadvantages of all credit options before making the final decision as to which method is best for you.

Comparison Table: Traditional Credit Cards vs BNPL Services vs Interest Free Credit Cards

Here’s a snapshot of the comparison between all three credit options.

Traditional Credit Cards

Credit cards have been around since 1974 and have been a common method for Australians to purchase high-priced products and repay the debt in more affordable monthly instalments. However, any time you use a credit card to purchase a product, you’re borrowing money and creating debt. The more you borrow without repaying, the higher the debt will be and the harder it will be to repay.

Advantages

- Freedom to purchase from a variety of different stores

- Many lenders offer credit cards with rewards programs attached

- Allows you to purchase a product that you may not be able to otherwise afford

- May help in an emergency

Disadvantages

- Very high interest rates with some cards charging up to 21.99% p.a

- The interest on credit cards compounds daily – meaning you could end up paying interest on your interest charges

- May hurt your credit score if you default

Buy Now Pay Later (BNPL) Services

Buy-now-pay-later interest-free finance methods have become an increasingly popular way for Australians to purchase products and services from multiple stores and providers. It allows you to purchase a product now, take the product home and pay for it in manageable monthly instalments.

Although they may be a better alternative to paying the high interest that traditional credit cards bring with them, Mozo’s 2020 BNPL report found that around two million BNPL shoppers in Australia are financially stressed and unsure how they are going to meet their repayments due to high unemployment rates and wage reductions because of the ongoing Coronavirus pandemic.

Advantages

- More affordable, monthly repayments

- Has no interest charges

- No need for a credit check to be approved for the service

Disadvantages

- High fees if you miss a payment

- If you miss a repayment, you can’t purchase anything else until the account has been settled

- There are generally extra charges such as setup fees and monthly account keeping fees

- May negatively affect future loan applications

Interest Free or No Interest Credit Cards

An interest-free credit card is a new type of credit card introduced to combat the rise of Australians using BNPL services. It gives you a credit limit of $1,000, $2,000 or $3,000 for you to use on purchases without paying interest – just an ongoing monthly fee (dependent on the credit limit).

NAB personal banking executive Rachel Slade told Broker News “credit cards have not really evolved in recent years, but our customers’ needs and expectations are changing and we want to change with them.”

Revive Financial’s lending manager, Meegan Hays, says that a low limit, interest free credit card may be a more viable option for older Australians or those on a low income.

“Instead of falling into a credit card debt trap with a traditional card, these new options may help people to maintain their repayments and keep on top of their debt.”

Advantages

- Continual line of credit that can be used anywhere

- Can continue to purchase products until it reaches the limit, even if the credit card has an outstanding monthly fee

- No interest

- If you don’t use the card for an entire month, the monthly fee is waived

Disadvantages

- Only a small credit limit

- No cash advances

- No balance transfers

I Already Have Credit Card Debt. How do I Pay it Off?

If you have an outstanding credit card debt, some of the best ways to pay it off include:

- Setting goals, creating a budget and keeping up with repayments,

- Using a debt reduction strategy, or

- Taking out a debt consolidation loan.

Get in touch with us on 1800 534 534 for a free consultation with one of our expert team members to discuss your options.