As a small business owner, being able to access business loans to support your operations and growth is often critical.

Whether you want a loan to expand or launch a new product, or your finances are tight and you need a bump up to cover day-to-day expenses, a business loan can bridge the gap.

If you can realistically pay back a business loan, great. However, if you have some concerns over repayment or you’re looking at easy-to-access loans due to a shaky financial history, it’s best to step back and do some due diligence first.

A business loan calculator is a great tool for this.

How Our Business Loan Calculator Works

Our online business loan calculator can help you work out the total cost of your business loan, including interest and your monthly, fortnightly or weekly business loan repayments—and it’s easy to use.

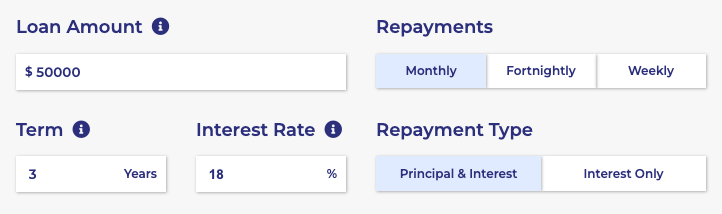

Simply add the following information relating to the specific loans you’re looking at into our business loan repayment calculator to get your result:

- Loan amount

- Repayments (monthly, fortnightly or weekly)

- Term (in years)

- Interest rate (%)

- Repayment type (principal and interest or interest only)

Here's an example:

- Loan amount: $50,000

- Repayments: Monthly

- Loan term: 3 years

- Interest rate: 18%

- Repayment type: principal and interest

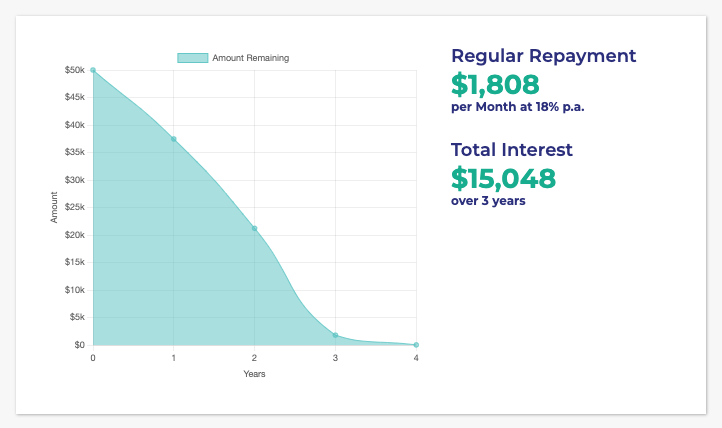

Result

- Monthly repayment: $1,808

- Total interest: $15,048

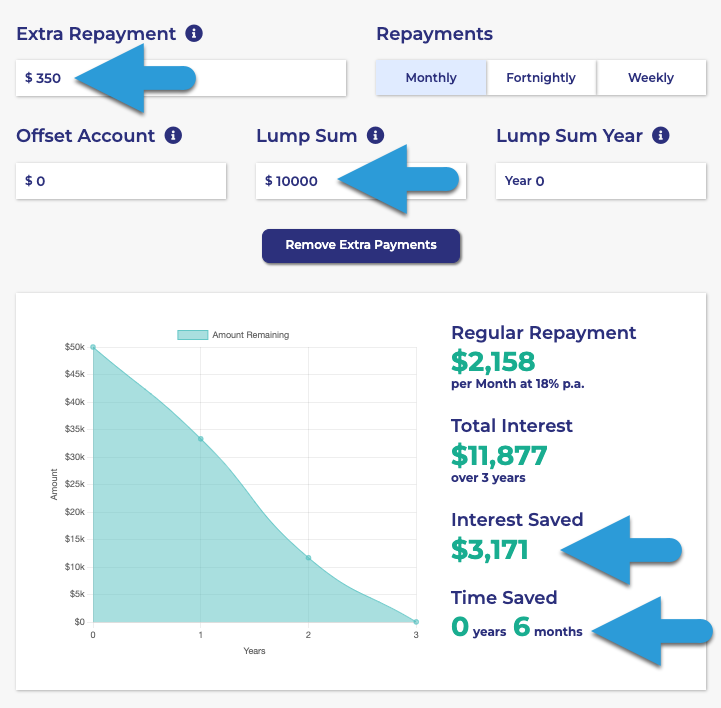

Use this information to make an informed decision about whether a particular business loan is a sensible choice for you. You can also calculate the interest and time you can save if you make extra regular or lump sum repayments:

Consider: Are the monthly repayments doable with all your other commitments? And are you comfortable paying that much back in interest?

Alongside our business loan repayment calculator, you can also find helpful business loan tips, such as setting a business budget. Plus, there are links to our other online debt calculators.

What Business Loans Can You Access?

As of August 2022, small businesses in Australia had $142 billion in outstanding loans.

If you’re weighing up your business loan options, here are some of the main ones you’ll see if you’re not in a position to be able to access a secured loan, for example, because of a lack of assets, time or a poor credit history.

Unsecured business loans

An unsecured business loan is a type of loan that doesn’t require physical assets for security, for example, property, vehicles and inventory. Instead, lenders look at the strength of your cash flow. They’re generally for smaller amounts (up to $100,000).

Pros: Quick approval, less upfront paperwork

Cons: Higher interest rates, more risk for lenders

Bad credit business loans

Bad credit business loans are similar to unsecured loans but are designed for business borrowers with a bad credit score. Your application is assessed on the strength of your cash flow and overall credit history.

Pros: Access to funds, quick approval

Cons: Highest rates and fees, shorter terms

ABN loans

ABN loans are loans available for Australian Business Number (ABN) holders. ABN loan lenders use your ABN to decide your creditworthiness, financial status and existence of your business and whether you can be trusted to repay.

Pros: No credit check, fast finance

Cons: Smaller amounts (up to $15,000), specific restrictions

Low doc business loans

Low doc business loans allow you to access finance when you can’t supply the usual financial statements, tax returns, or other documentation lenders typically require for loan approval. You normally just provide personal documents.

Pros: Easy qualification, quick approval

Cons: Higher interest rates, shorter terms

The Risks of Specialist Business Loans

While these types of loans, essentially all types of low doc business loans, offer faster funds if you have difficulty providing extensive documentation, they come with risks and drawbacks.

As the cons show, they present higher interest rates and fees than traditional secured lending. They’re also often shorter-term.

In addition to this, specialist business loans:

- Are riskier - Lenders don’t have a full understanding of your financial situation and ability to repay

- Increase borrowing - You might be tempted to borrow more than you can afford to repay

- Have reduced consumer protection - This could lead to unfavourable terms without adequate protection

- Lack transparency - This means you may not fully understand the terms, conditions and potential risks associated with the loan

- Increase default potential - You may struggle to make repayments due to insufficient income or cash flow

- See you being taken advantage of - You could be offered loans with unfavourable terms that exploit your lack of financial knowledge

Because of these risks, carefully consider your options and thoroughly understand the terms of any loan, regardless of the background information and checks required. We recommend seeking advice from a financial professional.

Don’t Pour Money into a Leaky Bucket

While quick, easy business loans may seem like a great option, they’re often an undesirable way to fund your business, especially if your company is already in a stressed financial position.

Rather than being a quick fix, the reality of a business loan is that it’s like pouring money into a leaky bucket. You can end up in a much worse financial situation than where you started.

If your business is struggling and you’re considering a business loan as a fix, as well as using our business loan calculator to calculate loan repayments, make sure you consider what other options are available to you. Small business restructuring can be a lower-risk and more effective alternative.

Used our business loan calculator to calculate repayments, but looking for professional, non-judgmental support and advice? Get in touch with our debt solution specialists today on 1800 861 247

.gif)