A legitimate restructure option to avoid being accused of phoenix activity

If a company fails and is placed into Liquidation or Administration, suddenly, there may be another company with a very similar name that starts trading, providing similar (or even the same) goods and services.

Is this fraudulent phoenix activity?

Unfortunately there’s no definitive answer, because there’s a big difference between fraudulent phoenix activity to avoid tax and other liabilities, and a business genuinely resurrecting itself using a new corporate structure.

What is illegal phoenix activity?

Right now there’s no legal definition of fraudulent or illegal phoenix activity.

However, both the Australian Securities and Investment Commission (ASIC) and the Australian Taxation Office (ATO) have their own definitions:

The ATO’s definition:

“We define fraudulent phoenix activity as the evasion of tax and or superannuation guarantee liabilities through the deliberate, systematic and sometimes cyclic liquidation of related corporate trading entities”.

ASIC’s definition:

“Phoenix activity involves the systematic act of transferring assets from an indebted company that has or will be wound up, into a new corporate structure that has the same directors or company officers. As a consequence of this conduct, the directors or company officers avoid paying outstanding liabilities owed to creditors, employees and statutory bodies incurred by the company that has been wound up, while continuing the same or similar business activities using the newly established company.”

As liquidators, we often need to determine whether fraudulent phoenix activity has taken place. so we use both definitions, along with these key indicators:

- Illegal or fraudulent intent to avoid tax and other statutory obligations

- Related corporate trading entities that don’t have any asset being liquidated systematically and sometimes in regular cycles

- Evidence the Directors of the company have deliberately incurred debt before the company transfer, with no expectation of the company repaying the debt

- A group of companies being intentionally structured to:

- avoid meeting certain statutory obligations

- avoid other creditors

- stream profits to other members of the group.

- Physical assets, contracts or supply agreements have been transferred from the debt-laden entity to a new entity for little or nil value

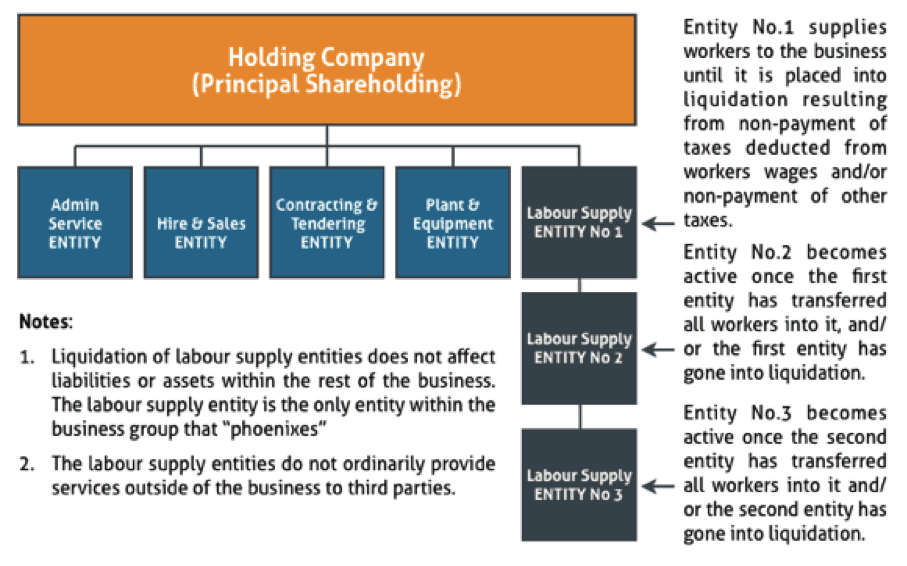

Here’s a theoretical example of fraudulent phoenix activity

A large labour hire business with minimal or no assets intentionally structures its operations across a web of related companies. The group’s assets are held in different entities, with no commercial agreement between the employing entity and the other entities within the group.

The employing entity fails to pay employees’ superannuation, workers compensation premiums and outstanding tax. The employing entities are later liquidated, and the workforce is transferred into new entities to continue trading.

The group has intentionally left behind unpaid taxes, superannuation and workers compensation debt. So in this case, it’s fraudulent phoenix activity.

Prepacking - a legitimate restructuring option

Now, here’s an example of the corporate form being used legitimately to restructure an insolvent company or business.

Mr Hard Worker, Director of I’m A Hard Worker Pty Ltd (“the Company”), becomes aware it can no longer pay its debts (it’s insolvent). Mr Hard Worker consults his advisor and they seek advice from a Liquidator about the Company’s solvency and potential options.

The Liquidators outline all options and risks associated with the Company’s insolvency, and Mr Hard Worker decides to place the Company into liquidation.

The Liquidators gets an independent valuation of the Company’s assets, and Mr Hard Worker arranges to purchase some from the Liquidator at market price. Mr Hard Worker then sets up a similar business using another company where he is also a Director.

The Liquidator pays the creditors on a pro-rata basis using the money they get from selling the assets. Unfortunately there’s only enough to pay the company’s outstanding creditors a dividend of 50 cents in the dollar.

This is just one example of using the corporate legislation legitimately to restructure an insolvent entity. Every situation is different, so they need to be considered case by case.

9 Considerations When Restructuring a Company Made Insolvent Through a Genuine Business Failure

1. Asset Transfers

Related parties can’t offset prior debt against the purchase of the assets. A liquidator has the power to challenge:

- uncommercial transactions

- unreasonable Director-related transactions

- transactions to defeat creditors.

2. New Structure

Any new structure must be profitable and comply with all its statutory obligations. Is the new venture really feasible? Do you have a business plan, cashflow and budgets?

3. Secured Creditors

You may need suppor from secured creditors (e.g. banks and other financiers) in a restructure that could include transferring facilities to a new entity. When considering a restructuring plan, you and your advisors to communicate openly and honestly with your financiers.

A party with a security interest in the whole (or a substantial part) of a company’s property has the right to appoint an administrator or receiver over the company’s assets.

4. Stigma of Liquidation

Consider the wider public perception of an insolvency appointment or turnaround plan on creditors, suppliers, employees and customers.

5. Breach of Director Duties

The Corporation Act imposes duties on Directors (including de facto and shadow Directors) including:

- acting with care and diligence

- acting in good faith and for a proper purpose section

- not improperly using their position, or any information obtained because of their position, to gain advantage for themselves or cause detriment to the company.

They also have a duty to prevent insolvent trading. When considering a restructure, you need keep your duties in mind as you make your decisions.

6. Disqualification of Directors

Any Director involved with two or more corporations that failed due to poor management within seven years can be disqualified from managing corporations for up to 10 years.

7. Insolvent Trading

Section 588G of the Act imposes liability on a company’s Director who allows the company to incur a debt when:

- the company is insolvent

- at the time the debt was incurred, reasonable grounds existed to suspect the company:

- was insolvent

- may become insolvent as a result of incurring the debt.

(A company is insolvent if it can’t pay its debts as they fall due.)

8. Potential Liability Under the ATO’s Director Penalty Notice (DPN) Regime

The DPN regime was amended on 29 June 2012 to reduce the scope for companies to engage in fraudulent phoenix activity. The DPN regime now:

- includes liabilities to pay superannuation guarantee amounts

- removes Directors’ ability to extinguish personal liabilities to pay penalties if PAYGW and Superannuation were unpaid and unreported for more than three months.

9. Contracts and Leases

Most contracts and leases contain insolvency clauses (or Ipso Facto clauses) that state the contract is automatically terminated in the event of insolvency.

If you’d like to confidentially discuss any of your clients’ situations regarding current or potential insolvency, get in touch and we’ll make a time to step you through the options and our process.

For more information on director advice, check out our director advice page here.